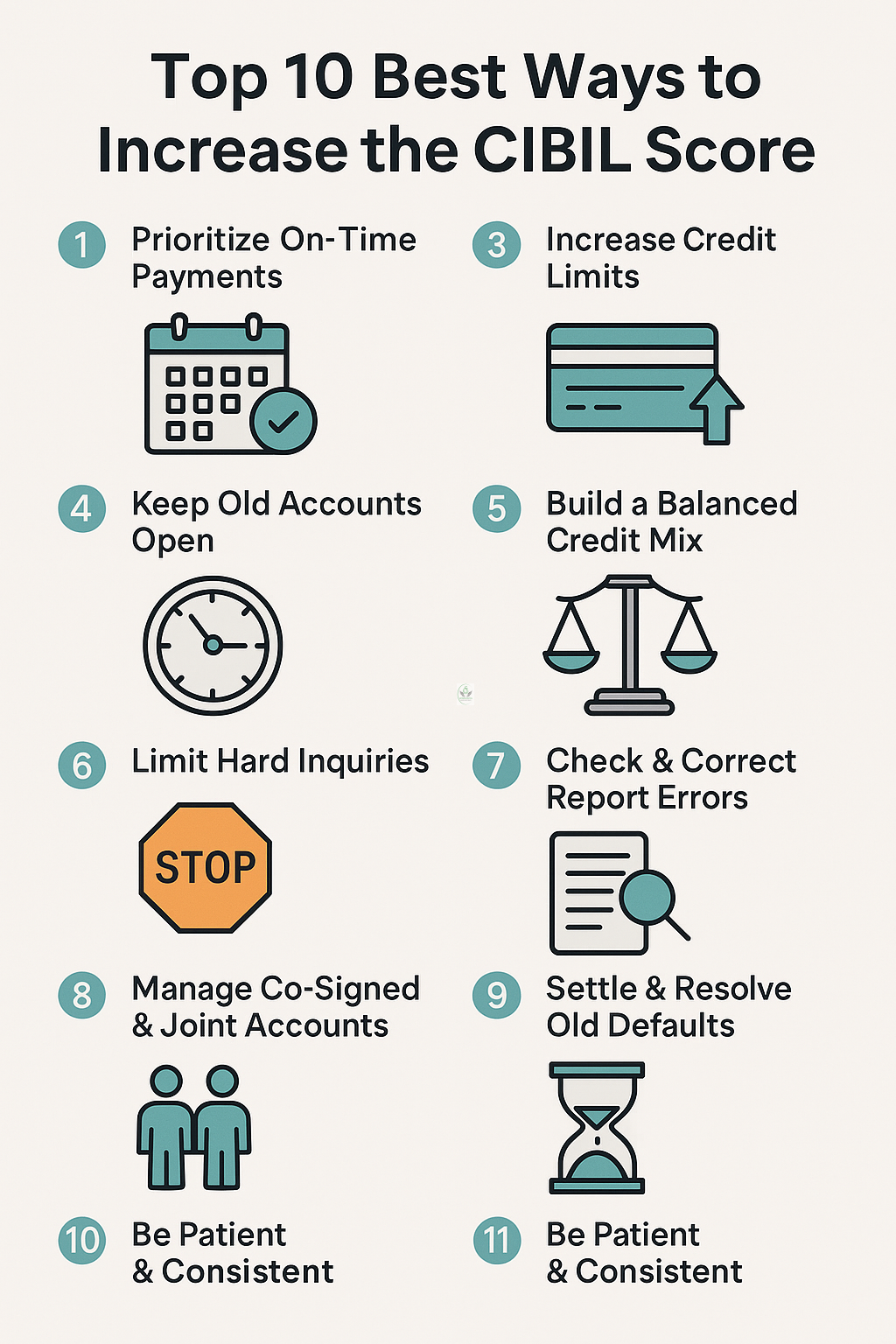

Top 10 Best Ways to Increase the Cibil Score

A high CIBIL score depends a lot on making payments on time, which usually accounts for about 35% of your score. Days Past Due (DPD) refers to payments for credit cards or EMI that are late, even by just a few days, and can stay on your credit report for up to 36 months. You can use standing instructions to set up automatic payments or set reminders to help you remember to pay on time. It’s important to pay the full amount owed to show you are responsible with money; just paying the minimum is not enough.Each time you make a payment on time, it helps improve your creditworthiness and shows lenders you are a reliable borrower. If you keep up with this consistently for a few months, you can see a noticeable increase in your score.Handling EMI payments early also helps you avoid late fees andthe stress of facing penalties.It’s also good to keep old, inactive credit cards active and make payments on them.

Master Your Credit Utilization Ratio

About 30% of your score is determined by your credit utilization, or how much of your available credit you are using.Experts advise limiting utilization to 30%, with ideal users aiming for 10% to 20%. For example, keep balances close to ₹10–30k per month with a ₹1 lakh limit.Even if payments are made on time, high utilization can lower your score because it indicates financial stress. Consider raising your credit limit without increasing your spending in order to control utilization.As an alternative, allocate balances wisely by distributing spending across several credit lines.Some users buffer utilization ratios by using high limit lifetime-free cards.If overall averages remain low, even sporadic spikes (like festival shopping) are excused.To avoid accidental overuse, set alerts to tell you when balances surpass a certain threshold.Disciplined credit behaviors are reflected in a utilization ratio that is steady and predictable.

Strategically Increase Credit Limits

Increasing the credit limit without increasing spending immediately lowers overall utilization. After regular use, many banks permit limit increases; take advantage of this.A slight increase can significantly reduce usage; for example, increasing from ₹50k to ₹1 lakh reduces usage of 25k from 50% to 25%.But just because you have more credit doesn’t mean you should spend more.Limit increases should be used as a tool rather than as authorization to run a tab.If a new card is offered, consider how it will affect your credit score before activating it.

After a number of on-time billing cycles, choose to request an increase.Additionally, higher limits protect usage ratios while assisting you in times of need.Don’t allow spending to increase; always keep an eye on the ratio, even after the limit has been raised.Creditworthiness is communicated to score algorithms through efficient limit management.

Preserve & Use Old Credit Accounts

About 10% to 15% of your CIBIL score depends on how long your credit history is. Even if you have old credit cards that are not being used, they still count towards your credit history and help improve your profile. If you close these accounts, it might reduce the total amount of credit you have access to and also lower the average age of your accounts. To keep old cards active, use them a little, maybe once every few months. You can use them for cheap things like monthly OTT subscriptions. This way, they stay active without you having to worry about high balances. Lenders see you as someone who can be trusted for the long term, and each positive action helps build that trust. These old accounts are important because they form the base of your credit history when you apply for loans. When you decide to stop using a card, it’s better to choose newer ones instead of older ones. Just having old accounts isn’t enough; you need to use them responsibly to get the best results. Combining good habits with a long credit history gives you the best chance of a good credit.

Develop a Balanced Credit Mix

About 10% of your credit score is based on your credit mix, which includes both secured and unsecured loans.When you have a mix of secured loans, like home or auto loans, and unsecured loans, like credit cards or personal loans, it shows that you can handle different types of debt. Taking out a small loan can show you can manage structured debt, while only having credit cards might suggest you depend too much on credit. Adding a small personal loan and paying it back fully adds diversity to your credit mix. Be careful—don’t take out loans you can’t afford to repay.Depending on your current financial goals, try to balance the types of debt you have.Secured loans usually last longer and have lower interest rates, which sends positive signals.Even a one-time structured EMI loan, when repaid carefully, can improve your credit mix.This variety is recognized by lending algorithms, which builds more trust in your risk profile.Having a mix shows confidence that,when handled properly, can improve your credit appeal.

Limit Hard Credit Inquiries

Each application for a loan or credit card results in a “hard inquiry,” which may marginally reduce your score.Making several hard inquiries in a short amount of time is seen as credit-hungry behavior. After one credit application has been processed, wait three to six months before submitting another.Self-checks and other soft inquiries don’t lower your score.To cut down on rejections, pre-qualify using inquiry-free tools prior to applying.Before submitting an official application, use eligibility checkers to evaluate your chances.To keep an eye out for possible declines in your score, track your inquiry log in credit reports.Steer clear of impulsive application triggers, such as bonuses or holiday promotions.Be cautious and only apply when credit is necessary and repayment is scheduled.Reducing the number of inquiries shows that your credit behavior is stable.

Regularly Audit Your Credit Reports

Errors in your credit report, like repeated accounts or wrong payment details, can quietly bring down your score. It’s a good idea to check your CIBIL report at least once a year through free or approved websites. If you find any problems, like old defaults showing up, you should report them right away.You can challenge incorrect information by providing settlement letters and proof that you’ve paid what you owed.Most disputes are resolved within 30 to 45 days, helping you get your credit score back on track quickly. Banks and consumer groups suggest keeping copies of No-Objection Certificates and transaction records.With faster reporting systems now in place, errors are fixed more quickly, which means your credit score can improve sooner.You can also watch how new credit activities are recorded by checking for changes in your report. This habit helps you make quick changes if needed.For lenders, having a clear and accurate credit report shows how healthy your credit really.

Handle Co-signed or Joint Accounts Carefully

The defaults of others whose loans you co-sign or guarantee affect your credit score.Keep yourself updated on payment balances and due dates; I’ve seen guarantors penalized for not spending any money.If you are not certain that the primary borrower is financially responsible, do not co-sign.Treat it like your own debt if you have to co-sign; use SIs or reminders to keep track of payments.Keep an eye on any joint account for its duration.In co-signed accounts, any missed EMIs are also displayed as your default.Verify the billing and payment patterns as well, if you are an authorized user.Too many shared credits can weaken your control, so think about limiting the number of these accounts.Even if you didn’t spend, lenders view joint liabilities as extra risk.Be proactive rather than passive in all shared interactions to safeguard your credit reputation.

Manage Outstanding & Settled Defaults

Your score may be negatively impacted for up to seven years by past defaults or settled loans.Pay off past-due loans, even if they are only partially due; formally settle with supporting documentation.If at all possible, steer clear of “settled” status; complete repayment is preferable to settlement.Negotiate a settlement, then obtain a No Dues Certificate to show closure.When paid, obtain closure letters and use lender assistance to remove co-signed or inactive loans.Keep an eye on your report after clearance to make sure status updates are updated within 30 to 60 days.Over time, having old debt paid off improves your age and utilization signals.After a default, start over by making careful payments on secured credit.Although it may take six to twelve months, recovery from default demonstrates dedication.Your insurance for a clean score is a clearance document.

Commit to Long-Term Financial Discipline

It takes at least six months of continuous good behavior to raise a CIBIL score.Stable habits are more effective than short-term adjustments, such as paying dues just before reporting.Establish logical financial objectives by keeping up with automation, keeping an eye on reports, and progressively expanding your credit.Reviews, even once a month, help you identify minor problems early and avoid major problems.Monitor your score every month; consistent improvement is encouraged when you see upward movement.Keep yourself updated: new regulations, such as RBI-led monthly or daily updates, will expedite credit.Over time, modify certain behaviors, such as rewarding credit use or refraining from impulsive applications.Positive outcomes are compounded by healthy routines like limit reviews and zero balance habits.Have patience.Disciplined steps can help you surpass 750 in less than a year, even if you start at 600+.Prioritize building good credit because it’s a marathon, not a sprint.

Conclusion:

Improving your CIBIL score takes time, consistency, and smart financial habits. By following these top 10 strategies, you can steadily build a stronger credit profile. Always pay dues on time, maintain a healthy credit mix, and avoid over-leveraging. Regularly monitor your credit report for errors and stay disciplined with your credit usage. A good CIBIL score opens the door to better financial opportunities and lower interest rates.

For More Details:

Contact Us: +91-9392211976 7207531976

Email : admin@skywingloans.com

Location : Uppal, Hyderabad.